Adding the flexibility to make retirement what YOU WANT it to be. Call 984-999-7799 to inquire more today!

Like your 401k, IRA, or annuities, your home’s equity is a powerful financial tool that can greatly enhance your retirement funding plan. A reverse mortgage is a loan for borrowers 62 and over that converts your home equity into cash. The unique benefit is that you don’t need to pay it back month after month. Interest and fees are added to the loan balance over time. You repay the loan when you leave the home, just like you would with a traditional mortgage.

The funds from your equity can come as a lump sum, installments, line of credit, or in a combination of these options. While the loan balance accrues interest over time, you are not required to make monthly mortgage payments on the loan as long as you live in the home.

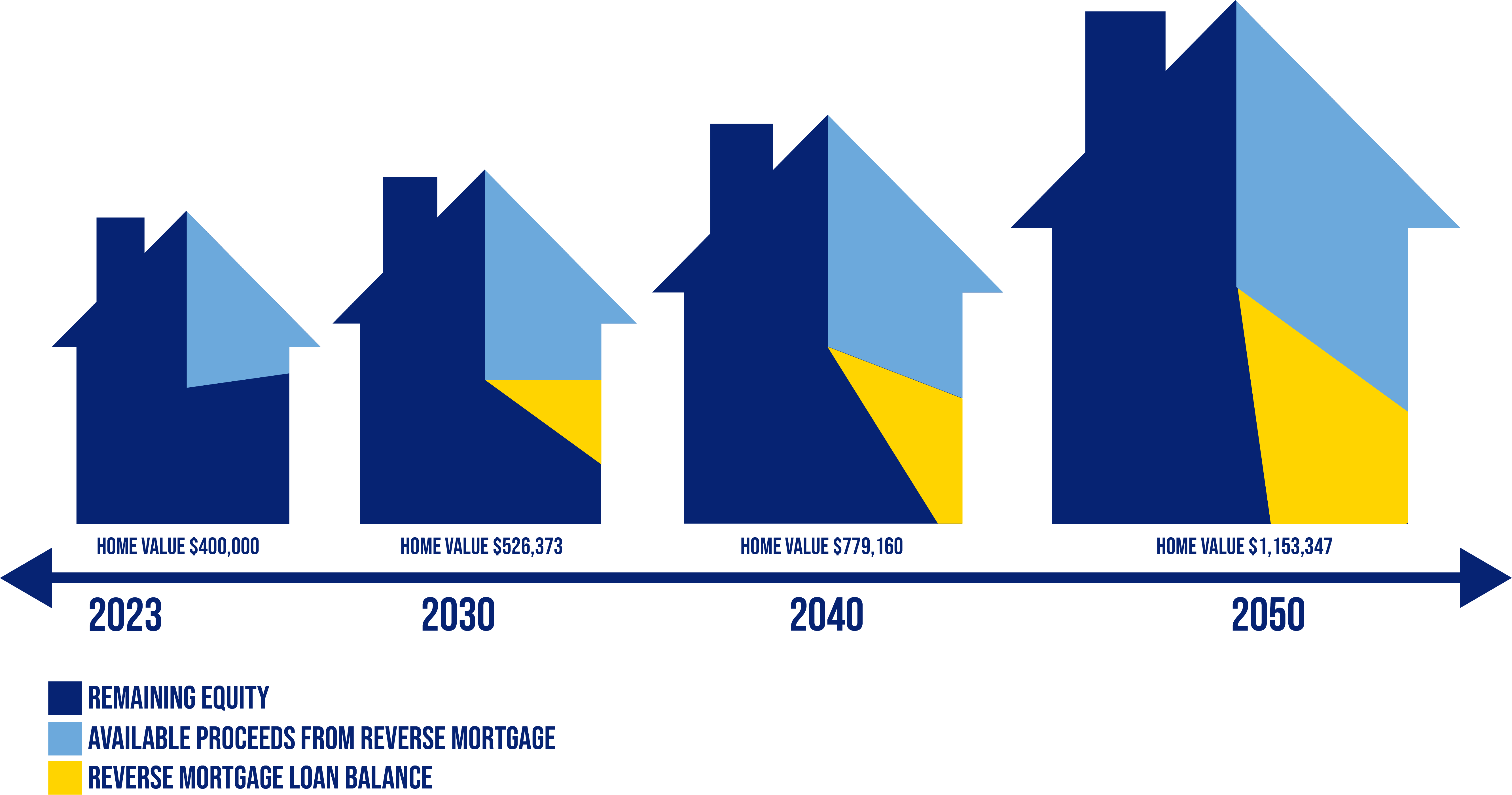

The example above shows that with a reverse mortgage, your equity and available assets may continue to grow each year. Even though you are taking money from your equity with a reverse mortgage, your house is not going underwater as long as the value of your home continues to appreciate. This example is based on a $400,000 current home value with the assumption of a 4% appreciation each year.

Reverse mortgages have high fees:

Just like a traditional mortgage, reverse mortgages have fees at closing. The fees of a reverse mortgage pay the lender, closing agent, appraiser, loan counselor, and the mortgage insurance on the loan. The fees can either be paid out of pocket or rolled into the loan, allowing for no out-of-pocket expenses at closing.

I will lose my home if home values drop:

Reverse mortgages are non-recourse loans, meaning you or your heirs will not be responsible for more than the home is worth. Your home still belongs to you, and you will not lose your home as long as the home is kept in good repair and you stay current on your taxes and insurance, which is true even if the home has no loan against it.

The bank owns my home, and it will not be left to my children:

Just like with a traditional mortgage, you will still own your home when you take out a reverse mortgage. When the home is sold, you or your heirs will get to keep the equity that's left.

I’m afraid my spouse will be kicked out of the house if I pass away:

The loan is based on the age of the YOUNGEST spouse living in the home. If either spouse passes away, the surviving spouse can continue living in the home and still benefit from the reverse mortgage. They don't have to make any payments on the loan, and they can stay in the home for as long as they want. The reverse mortgage will only come due when the home is sold or inherited.

A reverse mortgage can help you buy a new home even if you're retired. You don't have to make monthly mortgage payments; you can still use your home equity to get the money you need. This can give you more buying power and a better cash flow in retirement.

Reverse for Purchase

A reverse mortgage can be used to buy a new home in retirement, even if you don't have a lot of cash saved up. Or you can borrow money against the equity in your current home. This money can be used to purchase a new home.

Here are some of the benefits of using a reverse mortgage to buy a new home:

- You can borrow up to 65% of the appraised value of your current home.

- You don't have to make monthly payments on the loan.

- You can stay in your current home until you move out or pass away.

- The money you borrow can be used for any purpose.

Debt Consolidation

Many people have multiple monthly debts that can put a strain on their cash flow. By consolidating debt through a reverse mortgage on your existing mortgage and other debts, can free up your cash flow for other expenses.

Aging In Place

According to a survey by Merrill Lynch and AgeWave, 85% of retirees prefer to age in their own homes. However, many people believe that they must sell their homes to pay for long-term care. A reverse mortgage can provide income to help pay for long-term care or other expenses, allowing seniors to stay in their homes.

Growing Home Equity Line

Unlike a traditional home equity line of credit (HELOC), which requires repayment when you borrow money, a reverse mortgage home equity line of credit (HECM) can be accessed at any time without having to repay it. The line of credit grows every year at the effective interest rate of the loan. So you can borrow more money over time as your property value increases which can increase your spending power.

Coordinate With Your Retirement Portfolio In A Down Market

When the stock market is down, it can be tempting to withdraw money from your retirement savings to meet your spending needs. However, this can be a risky move, as you may be selling your investments at a loss.

A reverse mortgage can be a good way to meet your spending needs during a down market without liquidating your investments. With a reverse mortgage, you can borrow money against the equity in your home. This money can be used for any purpose, including paying for living expenses, medical bills, or home improvements. By using a reverse mortgage to meet spending goals during a down market, you can provide a larger total legacy.

Take a look at this example:

Let's say you are 68 with a home valued at $650,000 and a mortgage balance of $200,000.

Your mortgage payments are making it difficult to maintain your current lifestyle.

You would like to retire with no debt so that you can enjoy your golden years without financial worries.

However, you would rather not touch your investment accounts.

The reverse mortgage solution:

You recognize that your home is a financial asset that you can use to improve your retirement security, so you take out a reverse mortgage.

The reverse mortgage replaces your existing mortgage. You can tap into the equity in your home without having to make monthly mortgage payments.

In addition, you intend to withdraw a lump sum of money that you can use for whatever purpose you see fit.

By doing this, you can keep your retirement accounts intact and allow them to continue to grow.

As part of the reverse mortgage process, the lender must conduct a financial assessment to determine if you are eligible for a reverse mortgage. This process involves verifying your credit history and income from all sources, including employment, rentals, Social Security, investments, and other financial assets. You will need to give your consent for the lender to conduct this review. The financial assessment helps ensure that a reverse mortgage is right for you.

If you or someone you know are considering a reverse mortgage, please reach out to us today to go over your options. Learn more about the team that will help you thrive in your golden years by clicking HERE.

Ways to reach out to our team:

Email: Christina.Jasper@Benchmark.us

Phone: (984) 999-7799